What Are Pro Forma Financial Statements? Insights, Examples, and How to Create Them

It would be nice to peer into the future. To take a gander at what’s coming down the pike, adjust accordingly, and knock business decision after business decision out of the park. And while pro forma financial statements don’t quite provide a crystal ball level of omniscience, they sure do come in handy when it’s time to look at a what-if scenario or two.

Want to know what a potential business combination might look like a year from now? There’s a pro forma for that. Or maybe you want to look backward and see where you’d be today if that combination occurred last year. That’s what makes pro formas – latin for “matter of form” – so powerful and, to that point, why we’re going to spend the next few minutes discussing their applications and how to create them.

What Are Pro Forma Financial Statements?

As we said, a pro forma statement is a what-if scenario. It’s a tool that business owners, decision-makers, stakeholders, investors, creditors, and others use to examine hypothetical conditions. They can look forward or backward, revealing insights that standard financial statements simply cannot provide.

Further, while there’s definitely a right way and a wrong way to format a pro forma ‒ just ask the good folks at the Securities and Exchange Commission, AICPA, and FASB ‒ the term pro forma could mean an income statement, cash flow statement, or balance sheet. In other words, the different types of pro forma statements are basically the same financials you’re already accustomed to, just using hypothetical data for future periods. So, as you’ll see once we discuss how to create pro formas in just a bit, they don’t require you to recreate the financial reporting wheel, at least in terms of format.

However, we only feel it right to issue a big ol’ caveat before we go any further. As you might’ve noticed, we’ve used the word hypothetical several times already. And while pro formas can be enormously helpful in looking at different financial models based on various assumptions, they’re still – you guessed it – hypothetical.

Therefore, to paraphrase Merriam-Webster, pro formas involve or are based on a suggested idea or theory. Put another way, they use information that can vary substantially from actual data. So while pro formas are fantastic for looking at events from different angles, never take them as gospel, only well-informed conjecture.

When to Use Pro Forma Financial Statements

Now that we understand what a pro forma is and why they’re so uniquely insightful, let’s zoom in on how companies can use them.

Business Planning & Modeling

It’s helpful for FP&A to provide business leaders with side-by-side comparisons based on different assumptions, better informing the entire decision-making process. If, for instance, management is deciding between two separate proposals or business plans, they can use pro forma statements for each scenario and see which might serve their goals and vision best.

Further, the mere act of creating the pro forma statements for different scenarios is a useful exercise on its own, letting the decision-makers:

- Identify the different assumptions driving each of the scenarios

- Create sales and budget projections for each

- Collect the results in P&L projections

- Use the data to generate cash flow projections

- Compare the resulting pro forma balance sheets

- Gauge the effectiveness of each scenario against industry benchmarks using financial ratio analysis

In a sense, pro forma financial statements allow management to A/B test different strategies without any real-world impact. Using historical financial statements and a veritable cornucopia of assumptions, pro formas let you look at worst-case scenarios, best-case financial results, and everything in between, ultimately lending your business decisions more precision and confidence.

Gauge the Impact of Financial Decisions

Businesses commonly use pro forma statements to project the impact of a significant event or initiative, maybe a business combination, new line of credit, revamped accounts receivable processes, or possible restructuring costs. Harkening back to the previous section, a company can use a pro forma income statement, balance sheet, and cash-flow statement to project how these events might affect its financial position.

In this case, pro forma statements are like dipping your toe into the water before diving into the pool. If the water feels too cold – the pro forma financial projections and expected results aren’t favorable – it’s probably not a great idea to take a dip. But if the water is to your liking, you might benefit from a nice swim.

Financial Reporting

Of course, pro forma financial information isn’t just useful for internal purposes. Companies also use pro formas in external reports for stockholders, creditors, and potential investors. Publicly traded companies must include pro forma statements with any SEC filing, registration statements, or proxy statements. This only makes sense given the stockholders’ need to understand the impact of significant changes – relative to the company’s financial statements – that have either already occurred or will occur. Such changes might include:

- An updated estimate on the economic life and net residual value of an asset

- An updated estimate on the economic life and net residual value of an asset

- A business combination from an acquisition, disposition, investment, or combined interests of two or more existing business lines

- Correcting errors made in previously filed reports

Also, it’s important to remember the SEC, AICPA, and FASB have specific guidelines regarding the form, content, and necessity of pro forma financials under particular circumstances. Therefore, whatever prompts the need for them, you must adhere to any mandatory guidelines involved. For instance, SOX regulations state that a company must file a set of statements that conform to GAAP (generally accepted accounting principles) in conjunction with any pro formas to avoid giving the public a false impression of a company’s actual financial status.

Creating Pro Forma Statements

We’re going to take you through the steps necessary to create a basic full-year pro forma projection using an income statement, cash flow statement, and balance sheet. However, we’re lobbing another caveat your way – take our walk-throughs with a grain of salt since they’re only a glimpse into the basic pro forma process.

In other words, if you’re trying to attract investment capital or have an M&A transaction on your mind, you’ll want to use something more detailed and tailored for the purpose. Fortunately, you already happen to know a team of experts that can do just that for you. Wink, wink.

Pro Forma Income Statement

Let’s begin with the income statement, using a percent of sales forecast to keep everything straightforward. Start with an income statement from your most recent fiscal year and identify which items you’ll adjust for the projection.

As a slight aside, for more in-depth insights on pro forma adjustments as well as some handy best practices and examples, we urge you to look at our Ultimate Guide to Pro Forma Statements. For these walk-throughs, however, we’re assuming you’ve already looked over the different events and scenarios that can prompt pro forma adjustments.

Anyhoo, back to our regular programming. Now that you have your income statement in hand and adjustments on the ready, it’s time to begin the pro forma calculations. These should look incredibly familiar since it’s the same process you use when creating your typical income statements. The same holds true for the cash flow statement and balance sheet.

- Gross profit: Take your expected revenue adjustments – i.e., price changes, new product lines & customers, promotional offers – and inflate them by the expected amount. Do the same with the cost of goods sold (COGS) to arrive at your pro forma gross profit.

- Total operating expenses: Look through every line item and identify what costs you will cut in the following year. Make those cuts and then inflate your expenses by your projected rate for your pro forma total operating expenses.

- Net income before taxes: Net your gross profit and total operating expenses

- Taxes: Multiply your estimated tax rate by your net income

- Net income after taxes: Subtract your tax bill from your net income before taxes to arrive at your pro forma profit after taxes.

Since we used a sales-driven projection, other variables like operating expenses, depreciation & amortization, and interest expense were unaffected by our pro forma adjustments. This won’t necessarily be the case in a real-world application.

Pro Forma Balance Sheet

Given the relationship between your income statement and balance sheet, you’ll want to create the pro formas for each in conjunction with one another, using the following steps to generate your pro forma balance sheet:

- Transfer the change in retained earnings from your hot-off-the-presses pro forma income statement to the balance sheet.

- Identify adjustments to your current assets and liabilities that will vary according to the sales variance used in the projection.

- Use the usual suspects – total assets, total liabilities, owner's equity – to complete the balance sheet.

- Net income after taxes: Subtract your tax bill from your net income before taxes to arrive at your pro forma profit after taxes.

Remember, what distinguishes these pro forma statements from your standard financials are the adjustments, not the calculations or even the format. Certain regulatory bodies and scenarios will require specific information but, from a foundational perspective, the framework for each is essentially the same as what you already use when preparing your financials.

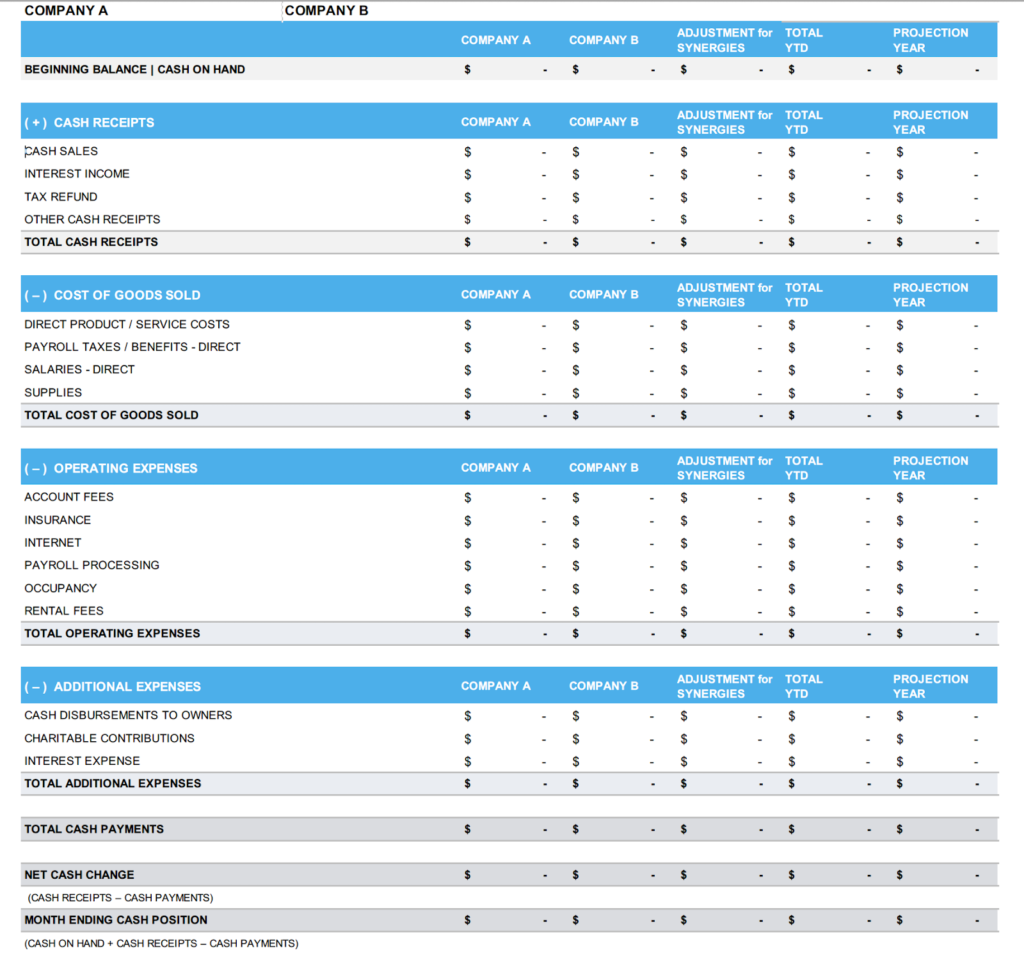

Pro Forma Cash Flow Statement

Finally, with the pro forma income statement and balance sheet complete, we can now knock out the cash flow statement.

- Start with your cash-on-hand, then add all cash receipts like sales, loans, cash injections, interest income, and others.

- List your outgoing cash payments like cost of sales, salaries, supplies, etc.

- Add up your operating expenses as well as any other expenses, including cash disbursements to owners, interest expense, income taxes, etc.

- Calculate your total cash payments, net cash change, and ending cash position. Once again, this is the same process you follow for your normal cash flow statement.

Putting Them Altogether

Now that you’ve done the brunt of the heavy lifting, you’ll want to make sure you’ve correctly linked the data between the pro formas. Double check you’ve:

- Added net income from the pro forma income statement to the accompanying balance sheet and statement of cash flows.

- Added depreciation back to capital expenditure on the cash flow statement, which then feeds PP&E on the balance sheet.

- Included interest from financing on the income statement since financing activity affects the balance sheet and cash.

- Correctly calculated your balance sheet's closing cash balance – the sum of the previous time period's closing cash and the current period's cash from operations, financing activities, and investing.

Other Pro Forma Scenarios

Alternatively, when you want to demonstrate the impact of different capital investment amounts, you can create multiple pro formas so a potential investor can see the varying effects on, as an example, the pro forma balance sheet.

Our point is, pro formas aren’t a one-trick pony. They have multiple uses for multiple scenarios, ranging from sales growth projections and risk analysis to more intricate M&A or investment purposes. Unfortunately, most organizations don’t have a fleet of battle-tested CPAs to fully leverage pro formas, especially startups and small businesses. Therefore, we again recommend checking out our Ultimate Guide to Pro Forma Financial Statements, where you’ll find even deeper insights and best practices. And just remember – if it all still seems a bit much, Embark is always around to swoop in and save the day. It’s what we do.

Original document, What Are Pro Forma Financial Statements? Insights, Examples, and How to Create Them

Source:https: embark

Adapted for Academy.Warriorrising