The challenges of growing a business - and how to meet them

Growing businesses face a range of challenges. As a business grows, different problems and opportunities demand different solutions – what worked a year ago might now be not the best approach. All too often, avoidable mistakes turn what could have been a great business into an also-ran.

Recognising and overcoming the common pitfalls associated with growth is essential if your business is to continue to grow and thrive. Crucially, you need to ensure that the steps you take today don’t themselves create additional problems for the future. Effective leadership will help you make the most of the opportunities, creating sustainable growth for the future.

This guide highlights the particular risks and mistakes that most commonly affect growing businesses and outlines what you can do about them.

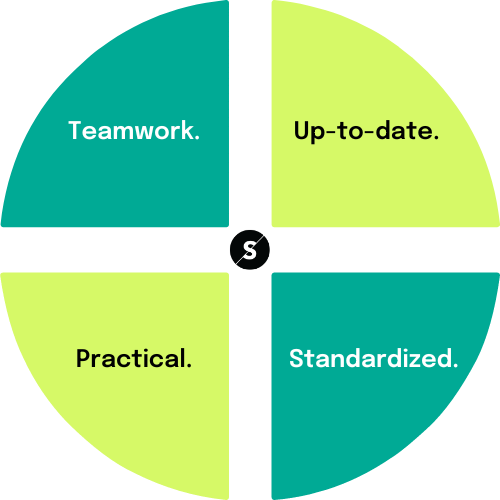

- Keeping up with the market

- Planning ahead

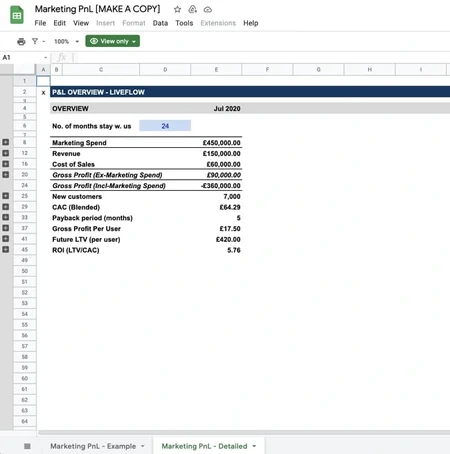

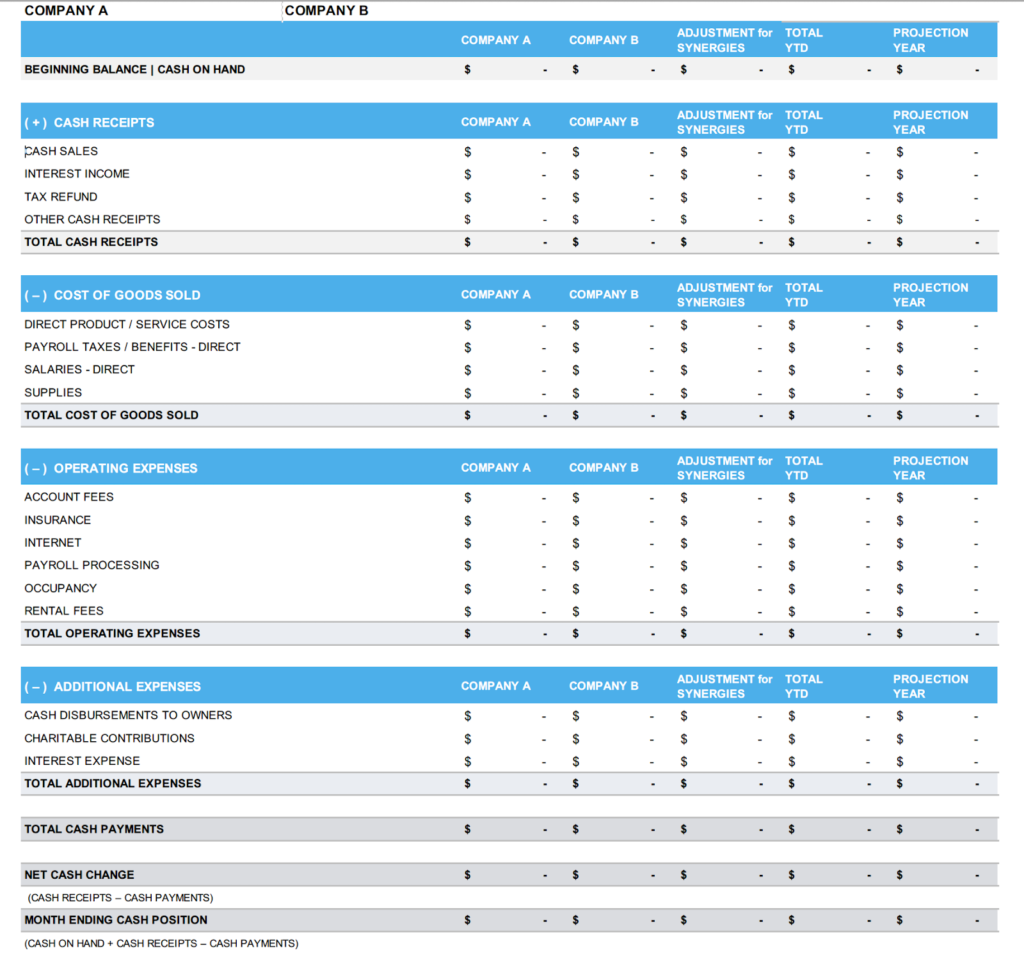

- Cash flow and financial management

- Problem solving

- The right systems

- Skills and attitudes

- Welcoming change

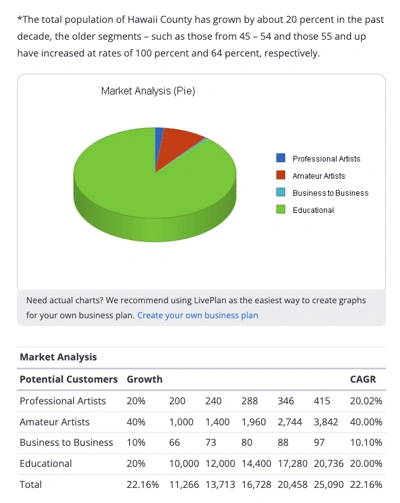

Market research isn’t something you do as a one-off when you launch your business. Business conditions change continually, so your market research should be continuous as well. Otherwise you run the risk of making business decisions based on out-of-date information, which can lead to business failure.

The more you succeed, the more competitors notice – and react to – what you are doing. A market-leading offer one day may be no better than average a few months later.

Apparently loyal customers can be quick to find alternative suppliers who provide a better deal.

As products (and services) age, sales growth and profit margins get squeezed. Understanding where your products are in their lifecycles can help you work out how to maximise overall profitability. At the same time, you need to invest in innovation to build a stream of new, profitable products to market.

Information sources

Published information can provide useful insights into market conditions and trends. As a growing business, your own experience can be even more valuable.

You should be able to build up an in-depth picture of what customers want, how they behave and which of your marketing approaches work best.

Taking the time to talk to key customers pays off. Your suppliers and other business partners can be important sources of market information. You should encourage your employees to share what they know about customers and the market. Effective IT systems can also make it easier to share and analyse key information such as customers’ purchasing behaviour and preferences.

You may want to carry out extra research as well – for example, to test customer reaction to a new product. You might do this yourself, or use a freelance researcher or market research agency.

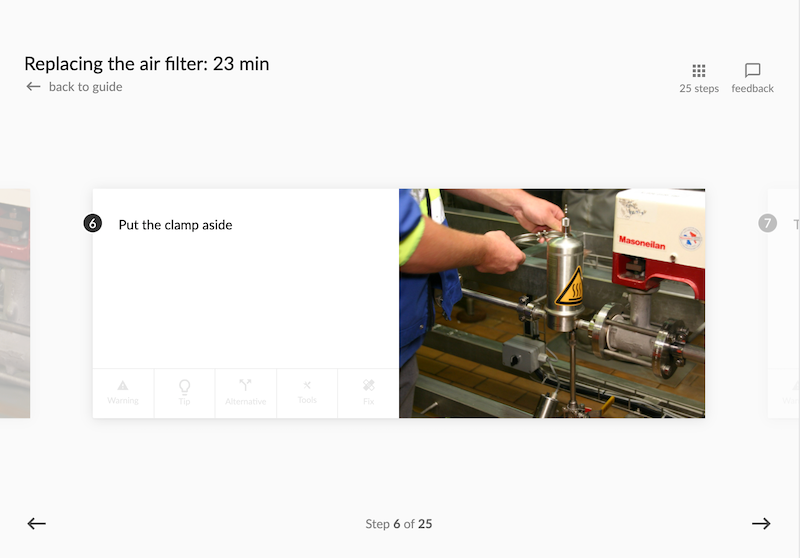

The plan that made sense for you a year ago isn’t necessarily right for you now. Market conditions continually change, so you need to revisit and update your business plan regularly. See the page in this guide on keeping up with the market.

As your business grows, your strategy needs to evolve to suit your changed circumstances. For example, your focus is likely to change from winning new customers to building profitable relationships and maximising growth with existing customers. Existing business relationships often have greater potential for profit and can also provide reliable cash flow. Newer relationships may increase turnover, but the profit margins may be lower, which may not be sustainable. See the page in this guide on cash flow and financial management.

At the same time, every business needs to be alert to new opportunities. There are obvious risks to relying solely on existing customers. Diversifying your customer base spreads those risks.

Following the same business model, but bigger, is not the only route to growth. There are other strategic options such as outsourcing or franchising that might provide better growth opportunities.

It’s important not to assume that your current success means that you will automatically be able to take advantage of these opportunities. Every major move needs planning in the same way as a new business launch.

Watch out for being too opportunistic – ask yourself whether new ideas suit your strengths and your overall vision of where the business is going. Bear in mind that every new development brings with it changing risks. It’s worth regularly reviewing the risks you face and developing contingency plans.

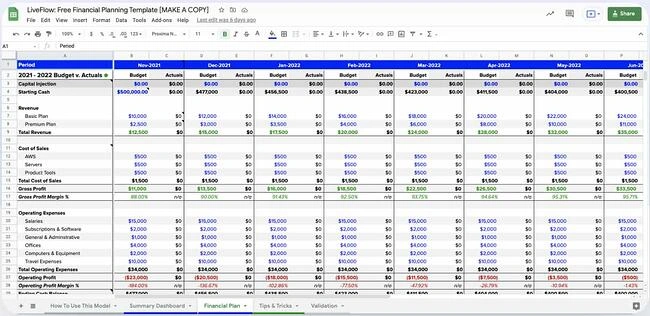

Good cash flow control is important for any business. For a growing business, it’s crucial – cash constraints can be the biggest factor limiting growth and overtrading can be fatal

.Making the best use of your finances should be a key element in business planning and assessing new opportunities. With limited resources, you may need to pass up promising opportunities if pursuing them would mean starving your core business of essential funding.

Every element of working capital should be carefully controlled to maximise your free cash flow. Effective credit management and tight control of overdue debts are essential. You may also want to consider raising financing against trade debts.

Good stock control and effective supplier management tend to become increasingly important as businesses grow. Holdings of obsolete stock may become a problem that needs periodic clearing up. You may want to work with suppliers to reduce delivery cycles, or switch to suppliers and systems that can handle just-in-time delivery.

Planning ahead helps you anticipate your financing needs and arrange suitable funding. For many growing businesses, a key decision is whether to bring in outside investors to provide the equity needed to underpin further expansion

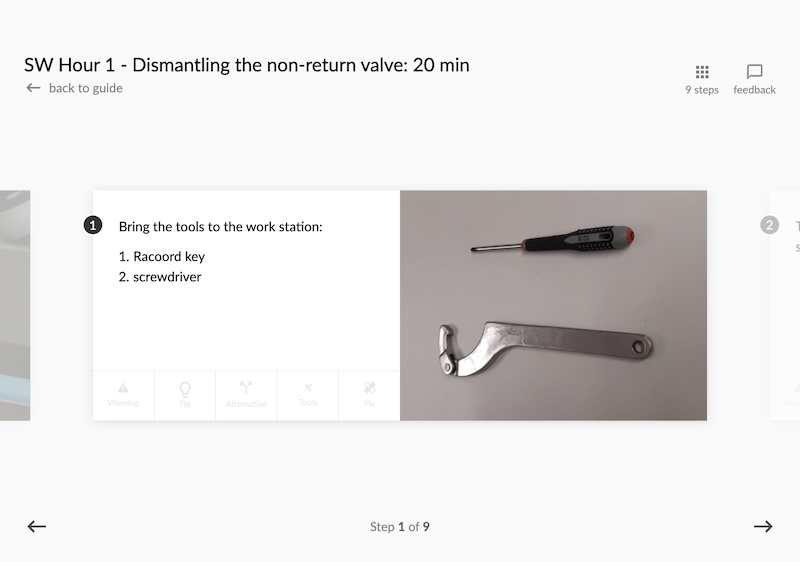

New businesses often run in perpetual crisis mode. Every day brings new challenges that urgently need resolving and management spends most of their time troubleshooting.

As your business grows, this approach simply doesn’t work. While a short-term crisis is always urgent, it may not matter nearly as much as other things you could be doing. Spending your time soothing an irritated customer might help protect that one relationship – but focusing instead on recruiting the right salesperson could lay the foundations of substantial new sales for years to come

.As your business grows, you also need to be alert to new problems and priorities.

For example, your business might be increasingly at risk unless you take steps to ensure your intellectual property is properly protected.

If you are focusing on individual marketing campaigns, you might need to devote more resources to developing your brand.

Identifying the key drivers of growth is a good way of understanding what to prioritise.

A disciplined approach to management focuses on leading employees, developing your management team and building your business strategy. Instead of treating each problem as a one-off, you develop systems and structures that make it easier to handle in the future.

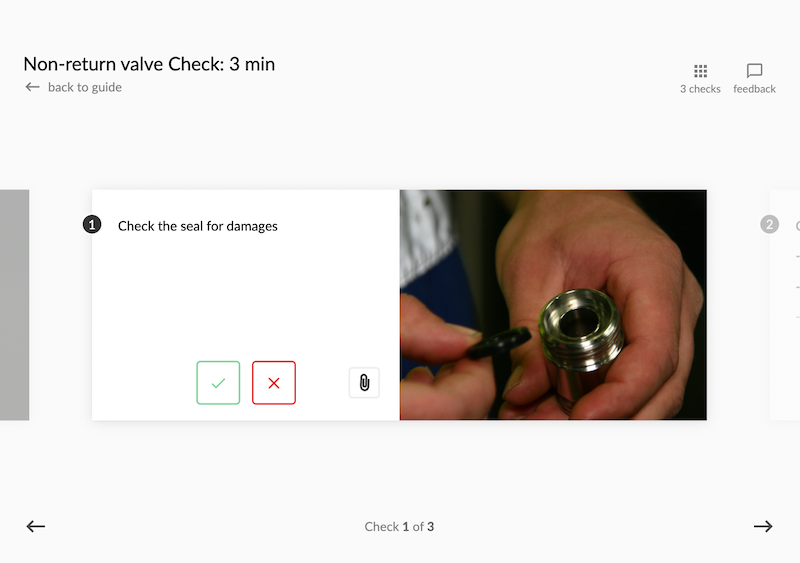

All businesses produce and rely on large volumes of information – financial records, interactions with customers and other business contacts, employee details, regulatory requirements and so on. It’s too much to keep track of – let alone use effectively – without the right systems.

Responsibilities and tasks can be delegated as your business grows, but without solid management information systems you cannot manage effectively. The larger your business grows, the harder it is to ensure that information is shared and different functions work together effectively. Putting the right infrastructure in place is an essential part of helping your business to grow.

Documentation, policies and procedures also become increasingly important. The informality that might work with one or two employees and a handful of customers simply isn’t practical in a growing business. You need proper contracts, clear terms and conditions, effective employment procedures and so on.

Many growing businesses find using established management standards one of the most effective ways of introducing best practice. Quality control systems can be an important part of driving improvements and convincing larger customers that you can be relied on.

Investing in the right systems is an investment that will pay off both short and long term. You benefit every day from more effective operations. If you ever decide to sell the business, demonstrating that you have well-run, efficient systems will be an important part of proving its value.

Entrepreneurs are the driving force behind creating and growing new businesses. All too often, they are also the people holding them back.

The abilities that can help you launch a business are not the same as those you need to help it grow. It’s vital not to fool yourself into valuing your own abilities too highly. The chances are that you’ll need training to learn the skills and attitudes required by someone who is leading growth.

To grow your business, you need to learn to delegate properly, trusting your management team and giving up day-to-day control of every detail. It’s all too easy to stifle creativity and motivation with excessive interference. As the business becomes more complex, you also need to develop your time management skills and learn to focus on what’s really important.

As your business grows, you may need to bring in outsiders to help. You’ll want to delegate responsibility for particular areas to different specialists, or appoint a non-executive director or two to strengthen your board. As you start tackling a new opportunity, someone who has experience of that activity can be vital.

For many successful entrepreneurs, learning to listen to – and take – advice is one of the hardest challenges they face. But it may also be essential if you are going to make the most of your opportunities. Some entrepreneurs, recognising their own limitations, even appoint someone else to act as managing director or chairman.

Complacency can be a major threat to a growing business. Assuming that you will continue to be successful simply because you have been in the past is very unwise.

Regularly revisiting and updating your business plan can help remind you of the changing market conditions and the need to respond to them. See the page in this guide on planning ahead.

An up-to-date plan helps you identify what action you need to take to change your business and the way it operates, for example:

Changing to suppliers who can grow with you and meet your new priorities. As your business grows, consistent quality and reliability may be more important than simply getting the cheapest offer.

Renegotiating contracts to take account of increased volume.

Training and developing employees. Your own role will also evolve as the business grows. See the page in this guide on skills and attitudes.

Making sure that you keep up to date with new technologies.

You need to be fully committed to your strategy, even if it takes you out of your comfort zone. This may involve hard decisions – for example making employees redundant or switching business away from suppliers you have become friends with. But unless you’re prepared to do this, you risk putting your business at a dangerous competitive disadvantage.

Original document, The challenges of growing a business – and how to meet them, © Crown copyright 2009

Source: Business Link UK (now GOV.UK/Business)

Adapted for Academy.Warriorrising